Malaysia đang trên đà trở thành trung tâm công nghệ lớn tiếp theo với hàng tỷ USD đầu tư từ bigtech

- Malaysia đang ở ngưỡng “điểm chuyển mình” trong lĩnh vực công nghệ, theo Khailee Ng, đối tác quản lý tại 500 Global.

- Các công ty lớn như Microsoft, Nvidia, Google, cùng với các nhà sản xuất chip Infineon và Intel, đã cam kết đầu tư hàng tỷ USD vào hạ tầng AI tại Malaysia.

- Infineon đã công bố kế hoạch xây dựng nhà máy sản xuất chip silicon carbide lớn nhất thế giới tại Malaysia, phục vụ cho các ngành công nghiệp tiên tiến như ô tô điện và tuabin gió.

- Tính đến tháng 5 năm 2023, Malaysia đã thu hút khoảng 76,1 tỷ ringgit (16,9 tỷ USD) đầu tư nước ngoài, cho thấy tiềm năng phát triển mạnh mẽ trong lĩnh vực khởi nghiệp.

- Ng nhấn mạnh rằng các nhà đầu tư cần có kỹ năng quan trọng trong các lĩnh vực như lắp ráp, đóng gói và thử nghiệm chip, để nâng cao năng lực thiết kế.

- Malaysia đã thiết lập một trung tâm thiết kế chip tại Selangor nhằm cải thiện khả năng thiết kế và vượt qua giai đoạn thử nghiệm và đóng gói.

- Bursa Malaysia đã chứng kiến 27 đợt niêm yết trong năm nay, thu hút tổng cộng 723 triệu USD, tăng 43% so với cùng kỳ năm trước.

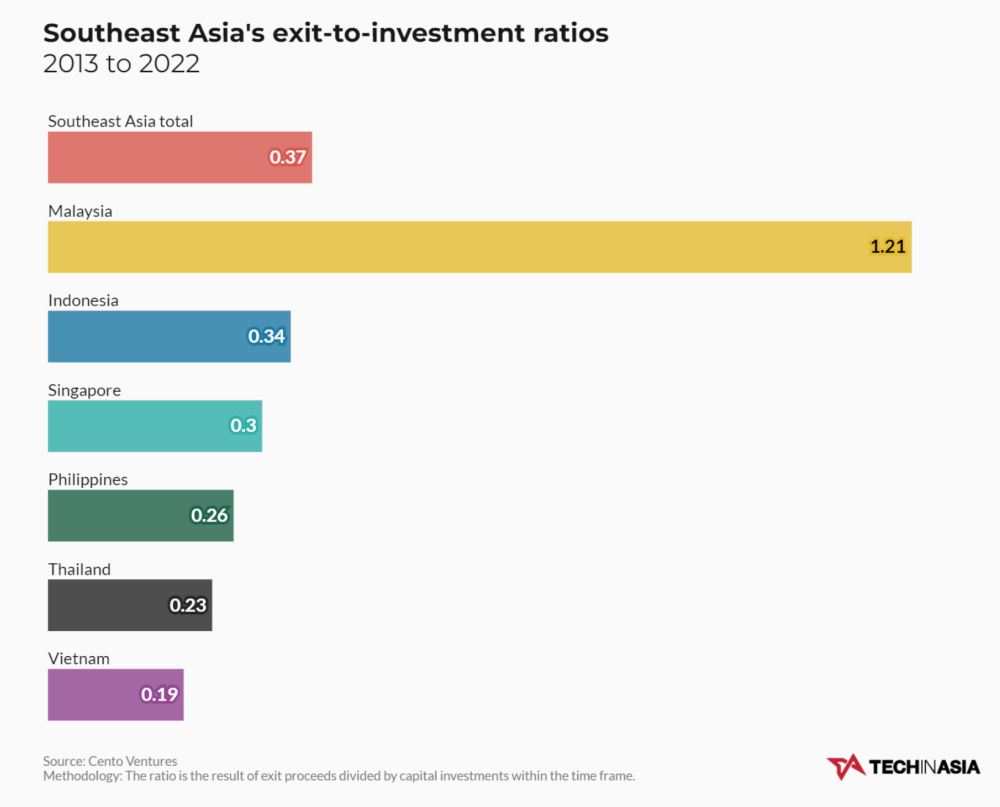

- Mặc dù thị trường đầu tư mạo hiểm đã giảm sút, Malaysia vẫn có tỷ lệ thoát vốn cao hơn so với các nước Đông Nam Á khác, với tỷ lệ 1,21 lần tổng vốn đầu tư từ 2013 đến 2022.

- Năm 2023, tổng vốn đầu tư công nghệ ở Đông Nam Á giảm 30% so với năm trước, xuống còn 5,5 tỷ USD, cho thấy một xu hướng khó khăn trong ngành.

- Ng cho rằng, những người sáng lập cần phải duy trì tham vọng lớn và không nên giảm quy mô kế hoạch của họ trong bối cảnh khó khăn của thị trường.

- Malaysia đã sản sinh ra nhiều lãnh đạo công nghệ xuất sắc, nhưng một số công ty lớn đã chuyển trụ sở sang Singapore để tận dụng các ưu đãi thuế và hệ sinh thái phát triển.

- Chính phủ Malaysia đã công bố lộ trình đầu tư mạo hiểm mới nhằm tạo điều kiện thuận lợi hơn cho việc huy động vốn.

📌 Malaysia đang trở thành điểm đến công nghệ hấp dẫn với hàng tỷ USD đầu tư từ các gã khổng lồ công nghệ, cùng với sự gia tăng trong khả năng thiết kế và phát triển khởi nghiệp. Chính phủ và các nhà đầu tư đang nỗ lực tạo ra một môi trường thuận lợi cho sự phát triển bền vững.

https://www.techinasia.com/malaysia-next-big-thing-in-tech-khailee-ng-explains

Malaysia = next big thing in tech? Khailee Ng explains Malaysia has long occupied a middle ground in Southeast Asia’s tech scene. The country is too small for massive investments like Indonesia but lacking Singapore’s global reach. This situation may be about to shift. Khailee Ng, managing partner at global early-stage VC firm 500 Global, believes that Malaysia is on the cusp of an “inflection point. In just a span of months, tech behemoths Microsoft, Nvidia, and Google, along with chipmakers Infineon and Intel, have committed to investing billions of US dollars to build AI infrastructure in the country. In August 2023, German chipmaker Infineon announced its plan to build the world’s largest production site for silicon carbide chips in Malaysia. The factory will produce chips used in advanced engineering like electric cars and wind turbines. In May, Prime Minister Anwar Ibrahim said the country has already attracted about 76.1 billion ringgit (US$16.9 billion) in foreign investment this year. Malaysian founders may not find a better time to build their companies, according to Ng, who’s one of the most prominent figures in Malaysia’s startup and tech scene. With the wave of investments sweeping the nation, the question, as Ng aptly posed, is: “How do we ride it?” Path to becoming an ‘innovation powerhouse’ Speaking at the recent Tech in Asia Conference Kuala Lumpur, Ng noted that some might question big tech’s investments in semiconductors, AI, and data centers will be enough to propel Malaysia to high-income status. Such investments are “not for the invention of AI. They’re not for the design of the semiconductors. They’re involved in packaging, assembling, testing,” Ng said. Still, he emphasized that it’s crucial for Malaysian workers to gain important skills in these jobs. He stressed that the US and South Korea began by imitating more advanced nations before becoming innovation powerhouses in their own right. The same trend is now happening in China. “Once upon a time, all of these nations were accused of being just low value imitators,” he said. “But imitation and learning best practices, learning the fundamental skills is a stepping stone that you cannot skip on your way up.” Malaysia is already aware of this, as it has just set up a chip design hub in the state of Selangor. The aim is to improve its design capabilities as a way to move beyond testing and packing. Bursa Malaysia has seen 27 debuts this year, which raised a total of US$723 million. The amount is 43% higher than that of the same period last year, even as IPO activity in Asia Pacific has been “subdued.” Homegrown unicorn Carsome also said it could consider listing in Malaysia instead of the US. Malaysia outperformed its peers in Southeast Asia in terms of exit-to-investment ratio, a Cento Ventures report from early 2023 found. Malaysian startups made 1.21x the total capital invested in them between 2013 and 2022. This is particularly noteworthy because within that time frame, Malaysia’s startup ecosystem raised only US$1.7 billion – lower than that of the Philippines (US$1.8 billion) and Thailand (US$1.9 billion). Ng acknowledged that the tech winter has been a “VC market drag.” Tech funding in Southeast Asia dropped to just US$5.5 billion in 2023, a 30% decline from US$8.4 billion in 2022, according to a report by Alternatives.pe and January Capital. On top of that, Indonesia-based eFishery was the only startup to turn unicorn in 2023. “Maybe a lot of venture capitalists are not investing at the pace and the speed and the size they’re used to,” he said. “And founders as well – they’ve started to be a bit less bold with some of their visions and their plans, right? There is a lot of hunger for profitability, but the plans are getting smaller and less exciting as well.” But that shouldn’t stop those who dare to go against the tide, according to Ng. Be the 1% For some founders, the common sense is to reduce “their big plans” to be “smaller, safer, and less ambitious” due to worsening market conditions, Ng said. This mindset, however, doesn’t apply to everyone. “[For] most tycoons in so many countries, the biggest lifts in their fortunes are made because of the plans they made when the economy was down,” said Ng. Meanwhile, the 1% – or what he termed the “baller level” – have plans that “shape and shake the market, and it creates confidence in others.” In other words, these business leaders “have made moves that fundamentally alter the trajectory of entire markets,” rather than following existing patterns. We’re gonna need a way to imbue this confidence and let it spread, because confidence breeds confidence. “So a lot of regional champions are built in the worst of times and without any good news,” Ng said. “All these Malaysian champions – it’s not just the founders, it’s all of you who had the confidence and made a plan to work in these companies, investors who had the confidence and made a plan to invest in these companies – all of you built this without any good news.” Despite its small size, Ng said that Malaysia has produced many outstanding tech leaders already, such as Grab co-founder Tan Hooi Ling and CTO Suthen Thomas, Carousel co-founder and CTO Lucas Ngoo, and Carsome CEO and founder Eric Cheng. At the same time, it’s worth noting that some Malaysian founders often run their companies out of Singapore. Grab is a famous example here: While originally a Malaysian company, it moved its headquarters to the city-state as it scaled regionally. It’s certainly a missed opportunity for Malaysia to claim perhaps the region’s most prominent tech company. At the same time, Singapore has long offered advantages like tax breaks and an established ecosystem to attract startups. Nevertheless, that shouldn’t take away confidence from Malaysian founders building in Malaysia. As Ng pointed out in his keynote, consumer spending is up, and so are the gross domestic product, the number of foreign tourists, and even JP Morgan’s credit rating. The government has also recently unveiled a new VC roadmap to make funding more accessible, among other things. Plus, Malaysians have also built companies beyond Singapore and Southeast Asia. For instance, renowned Malaysian-born entrepreneur Lip-Bu Tan led US semiconductor firm Cadence Design Systems for over a decade and founded VC firm Walden International, while Hock Tan currently heads another US semiconductor giant, Broadcom. “We’re gonna need a way to imbue this confidence and let it spread, because confidence breeds confidence,” Ng said. “Without this kind of confidence and a substantial source of confidence, you won’t have the conviction to build companies or invest in companies.” Currency converted from Malaysian ringgit to US dollar: US$1 = 4.49 ringgit

Thảo luận

Follow Us

Tin phổ biến