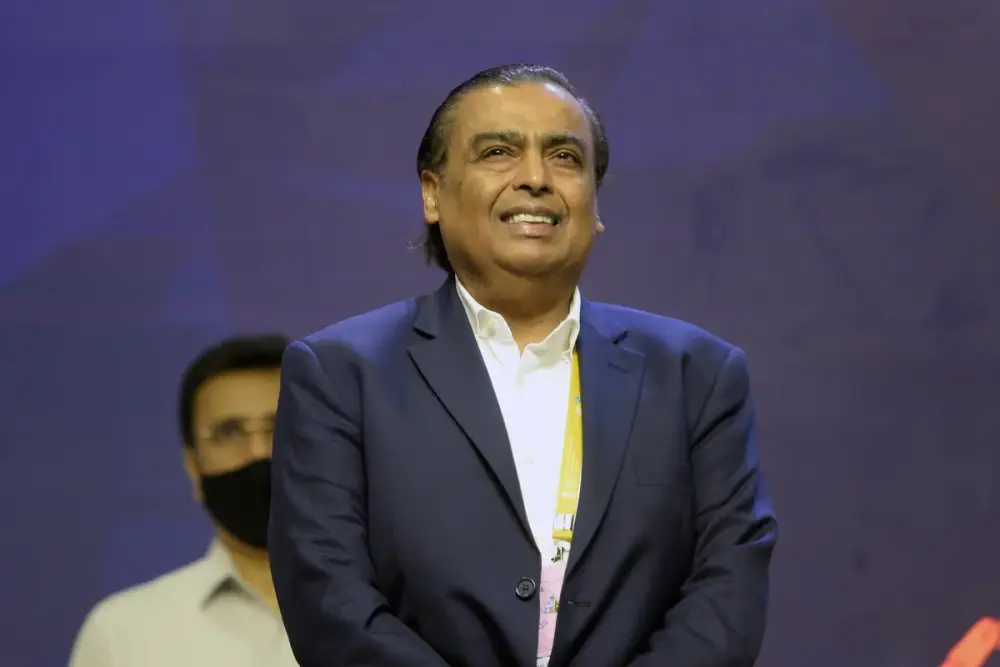

Mukesh Ambani’s Reliance Group is building what may become the world’s biggest data center by capacity in India, the latest in a blitz of global investments to capitalize on booming demand for artificial intelligence services.

The 67-year-old billionaire is buying

Nvidia Corp.’s powerful AI semiconductors and setting up a data center in the town of Jamnagar that’s expected to have a total capacity of three gigawatts, according to people familiar with the matter, who asked not to be identified because the details aren’t public. That would make it far bigger than any data center now operating.

Still, Ambani’s project, if it goes ahead as envisioned, stands out for its sheer size. The largest data centers operating now are less than 1 gigawatt, according to data provided by market intelligence firm DC Byte, which would make his several times larger than what’s on the market.

Data center capacity is often measured in the megawatts (millions of watts) of electricity that the site can feed into servers, cooling systems and other equipment. The larger the figure, the higher the volume of computing operations it can support. And AI models are notoriously compute-intensive.

Ambani built his reputation with aggressive business tactics, including a ruthless rush into the wireless business that sent prices plummeting and put several rivals out of business. His playbook seems similar in AI and he has said he will offer rock-bottom rates for what’s known as inferencing, or operating models like the ones that power ChatGPT. Inferencing costs can be onerous for companies like

OpenAI and local startups because they have to pay for computing resources every time a user has a query.

Reliance executives did not respond to multiple queries seeking comment.

It’s not clear how Ambani would pay for the project, which could cost $20 billion to $30 billion based on expenses in the region for such facilities.

Reliance Industries Ltd., the group’s primary listed entity, has the equivalent of about $26 billion on its balance sheet.

The Jamnagar facility would substantially boost India’s data center capacity, now estimated at less than 1 gigawatt. Tripling that size would give the world’s most populous country the potential to greatly accelerate its development of artificial intelligence.

Jamnagar, a town of more than 650,000 people, is located in Prime Minister Narendra Modi’s home state of Gujarat, and Ambani himself has familial roots in the state. It’s the hub of Reliance’s oil refining and petrochemicals complex, the world’s largest.

The town is becoming increasingly central to the conglomerate’s plans that include a push into renewable energy. Reliance has said it’s building a

gigantic green energy complex spread over 5,000 acres with factories to make photo-voltaic panels, fuel cell systems, green hydrogen, energy storage and wind turbines.

Reliance aims to power the new data center as much as possible with renewable energy, said the people. It will abut Reliance Group projects under way that will produce solar, wind and green hydrogen energy, according to one of the people.

It’s virtually impossible, however, to supply a continuous and dependable stream of solar and wind power without more consistent resources such as nuclear reactors, fossil fuel-fired plants or extraordinarily large battery systems to back it up. Reliance, whose roots lie in petroleum products, may require fossil fuels to back up its data centers.

The world’s biggest data centers by capacity are now all located in the US and owned by tech giants. Microsoft’s facility in Boydton, Virginia, is the largest with capacity of almost 600 megawatts and another 112 megawatts under construction, followed by Google and

Meta Platforms Inc. operations, according to DC Byte.

OpenAI, SoftBank and Oracle didn’t specify the size of the data centers they would build as part of the Stargate effort. Sam Altman, chief executive officer of OpenAI, has floated

the idea of building 5-gigawatt facilities but it’s unclear whether they’re in the works.

Ambani has previously spoken about his plans to drive down pricing in AI.

“By leveraging our expertise in infrastructure, networking, operations, software, and data and by collaborating with our global partners, our goal is to create the

world’s lowest AI inferencing cost, right here in India,” Ambani said last year at the company’s annual shareholders’ meeting. “This will make AI applications in India more affordable than anywhere else, making AI accessible to all.”

Demand for data centers equipped to host AI workloads is forecast to soar with the emergence of generative AI, the type of AI that generates content based on prompts - such as OpenAI’s ChatGPT. Experts are forecasting a looming capacity crunch as businesses adopt chatbots and generative AI tools to streamline work and boost productivity.

Global demand for data center capacity could

more than triple by 2030 to reach an annual level of 219 gigawatts, according to consultancy

McKinsey & Co. A potentially significant supply deficit is building up, with the US alone likely to face a shortfall of 15 gigawatts of capacity by 2030, the consultancy said, requiring an expansion of at least twice the data center capacity built since 2000.